THE 36-year-old Corus Hotel Kuala Lumpur in Jalan Ampang may be demolished to make way for an integrated development as the owner, Malayan United Industries Bhd (MUI), is considering unlocking the value of the strategically located land.

It is mulling the construction of a 55-storey building comprising serviced apartments, co-working space, a hotel and a retail component with an estimated gross development value of RM1.3 billion.

Having abandoned plans to sell the Corus Hotel Hyde Park in London, the UK, MUI is also evaluating the option of selling Corus Hotel Kuala Lumpur and a parcel of land in Negeri Sembilan.

“There are developmental opportunities with the site, which we have started to explore by engaging an architect to see what the highest and best use would be for it. For example, by redeveloping the site, we will be able to maximise the plot ratio (in the region of 10 to 12), which is currently underutilised with the existing building structure,” MUI Group chairman and CEO Andrew Khoo Boo Yeow tells The Edge when asked to comment on rumours about the redevelopment of its hotel.

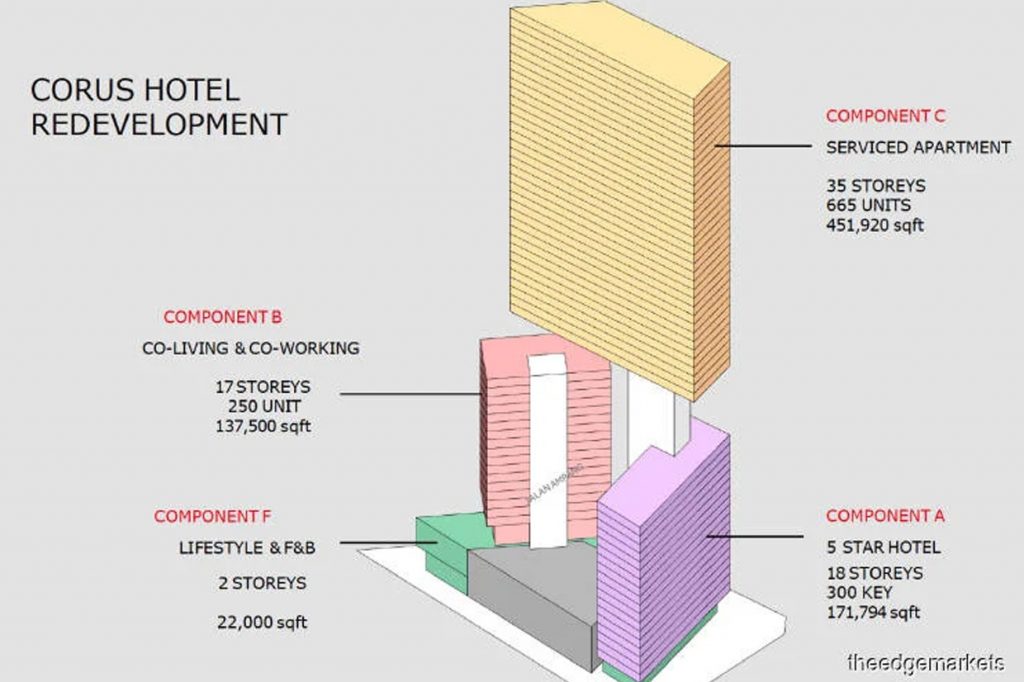

“One of the conceptual designs does indeed contemplate three towers,” Khoo says, but he stresses the plans are preliminary and subject to further refinement.

Based on the plans shared with The Edge, the development will include a 300-key, five-star hotel component in an 18-storey block, 250 units for co-living and co-working in a 17-storey block and 665 serviced apartments in a 35-storey tower. The entire structure will sit atop a two-storey podium that will offer lifestyle and food and beverage outlets (see artist’s impression).

On whether MUI plans to sell the development or retain it for recurring income, Khoo says, “The beauty about the design is that it provides us with flexibility going forward. With the multi-use site comprising a few structures, we have the option to sell either partially or entirely. The retail podium is expected to have a focused use and, typically, that portion would be kept.”

Asked if MUI, which also has a property development arm, will redevelop the site on its own or seek a joint-venture partner, Khoo says the company is open to whichever structure works best. “If it is to be on a JV basis, it would have to be with a like-minded partner who sees the value in the project and what we are trying to accomplish.”

According to industry sources, MUI had initially considered selling the hotel. They say, however, that the asking price for the four-star 388-room hotel, which sits on a 64,691 sq ft freehold parcel, was high. Khoo says MUI is open to selling the hotel.

“We have not officially put Corus Hotel KL on the market as we view it as a prime asset due to its strategic proximity to KLCC and the surrounding neighbourhood. However, we do from time to time get approached by interested parties as they see the inherent upside of the location. On the right terms, we are open to exploring a divestment,” he says, adding that the appraised value of the hotel is above RM300 million. This means that MUI was looking at at least RM773,000 per room.

“…we have not settled on selling the hotel as we may embark on a redevelopment of the site to further unlock value. Should we decide to sell the hotel, the process will be used to bring down our gearing and to also deploy for other business development opportunities,” he says.

Total borrowings as at Dec 31, 2019, stood at RM846.77 million.

Corus Hotel KL was previously known as Ming Court Hotel. It was named after the Singapore Ming Court Hotel, which was acquired by the group in 1980. The KL hotel was built in 1984 and adopted the character and theme of the Singapore hotel, especially the Ming Warrior doorman, a popular icon then.

As for Corus Hyde Park, London, MUI has officially taken the hotel off the market as it felt it was not an appropriate time to sell it. Corus Hotels UK has secured an additional line of £20 million to upgrade the hotel. “Prior to Covid-19, the hotel was achieving a historical high in terms of financial performance. With the repositioning of the hotel, we believe we will be able to drive performance even higher,” Khoo says.

Asked to confirm if the group is also looking to sell a parcel of land in Seremban, Negeri Sembilan, Khoo neither confirmed nor denied it. Instead he went on to provide details about the land saying that the property is located at the heart of Seremban city centre. It remains one of the last large commercial sites in the area and is ideal for a large-scale mixed-used development,” he says, adding that recent transaction data shows commercial property transacting at over RM150 per sq ft in the area. This means the land — comprising five lots with a total of 6.46 acres — may fetch as much as RM41 million. Four of the five lots have commercial zoning while one lot, measuring 1.63 acres, has been zoned for open space and recreation. The land has a permissible plot ratio of 5.

MUI is also trying to dispose of a 145,843 sq ft freehold retail asset located in Kompleks Bukit Jambul, which is occupied by Mydin hypermarket.